.png)

7 DAy ICT MASTER

Your Guide To Profitability !

.png)

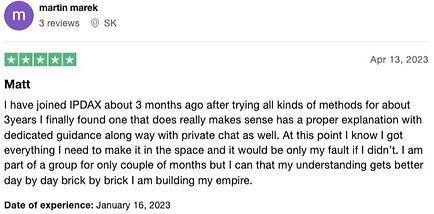

This Could Be You.

Take Charge

Check Out Our Curriculum

The Paradigm Shift into logic and delivery.

The Anatomy of a Dealing range Phases of a high probability pricing sequence Market efficiency cycle Pricing and Repricing Institutional Order Flow - Intro The understanding of Balanced Price Ranges Fair value & Fair Market Value The Change in State of delivery

IPDA Market Structure: The Blending of Framework & Algorithmic Principle

Simplicity of the only two signatures in Price How to use the imbalance as true market structure Understanding market fractals and the inception of new fractals Why the phases of high probability pricing sequences matter Cracks in Correlation / Smart money exposure Institutional order flow - The advancement

The Market Maker Profiles, Bias & Sneak Peak Into using Logic Behind Entries

The buy side of the curve The sell side of the curve Institutional order flow - The expanded understanding Understanding the buy program and sell program as a fractal Identifying where I am within a market cycle & how to engage Blending the anatomy of a candle with the market maker profile Governing decisions through solidifying framework How understanding OHLC and OLHC dynamic of a candles creation aids in proficient thinking Moving from “reactive” thinking & Seeing price through the lens of “response” to validate execution

Bias: Framing Direction by thinking in Systems based on Algorithmic Principle

The law of probability frames the Draw Using the dynamic of weekly range expansion to frame narrative The opening price of each interval Proficiency in utilizing daily profiles to align with narrative and bias How to think of each Daily profile as fractal that creates the weekly profile Institutional order flow

Three Advanced Step-by-Step Entry Models

Discover precision trading through our Three Advanced Entry Models, meticulously designed to leverage our deep mastery of ICT concepts. These models enable you to: Trade the Response, Not the Array: Learn to identify and execute at the market’s reaction points, avoiding the pitfalls of blindly targeting the array itself. Optimize Entry Timing: Step into trades with precise timing, aligning your strategy with market behavior for maximum efficiency. Enhance Objectivity and Clarity: Apply a structured, systematic approach to entries, removing emotional decision-making and building confidence. With these models, you’ll gain the tools to enter the market with unparalleled clarity, focus, and control, setting yourself up for consistent success.

Deeper Elements of TIme: The true understanding to time delivering price

Revisiting killzones Using the relationship of each killzone for routine development Unseen voids Time distortion Standard deviations and confluences with PD ARRAYS

Closing the Gap of what I know and my bottom line result:

Trading plan development Elements to the Universal trading model Elements to the NEW YORK OPEN professional Elements to the LONDON OPEN professional Elements to the INDEX LUNCH Hour Professional Defining my stage, set up, pattern, time, entry model

The Refinement:

Putting all of the pieces together Defining the blueprint Q/A clean up